Which of the Following Bonds Is Trading at a Premium

B a ten-year bond with a 4000 face value whose yield to maturity is 60 and coupon rate is 59 APR paid semiannually. A a five-year bond with a 2000 face value whose yield to maturity is 70 and coupon rate is 72 APR paid semiannually.

What Does It Mean When A Bond Is Selling At A Premium Is It A Good Investment

Thus the bond will be trading at par.

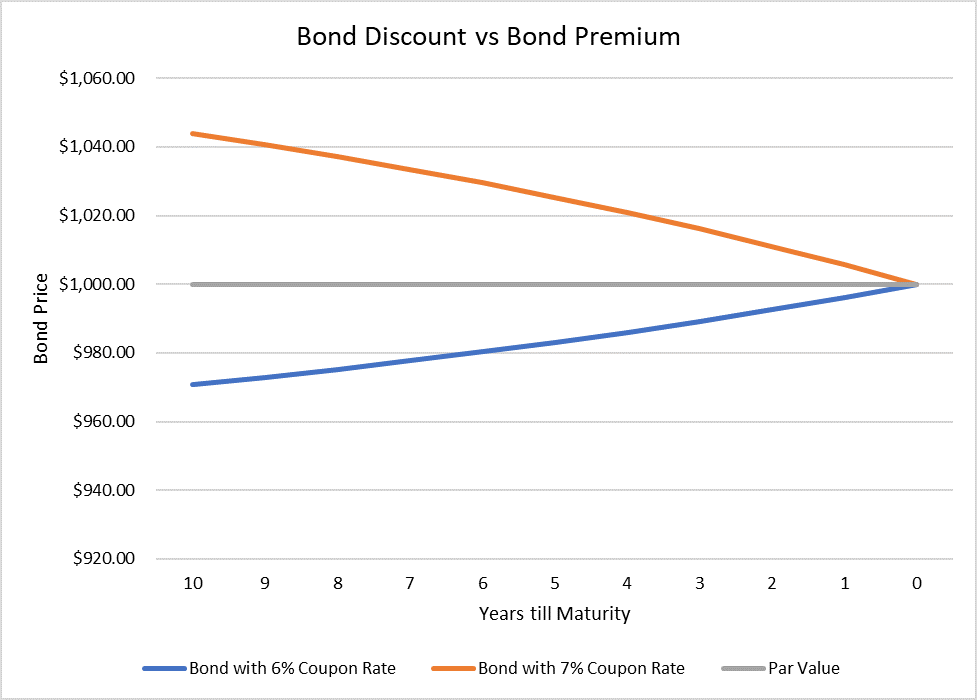

. Consider a bond with a 5-year maturity and a coupon rate of 5. Which of the following bonds is trading at par. If a bonds yield to maturity exceeds its annual coupon then the bond will be trading at a premium.

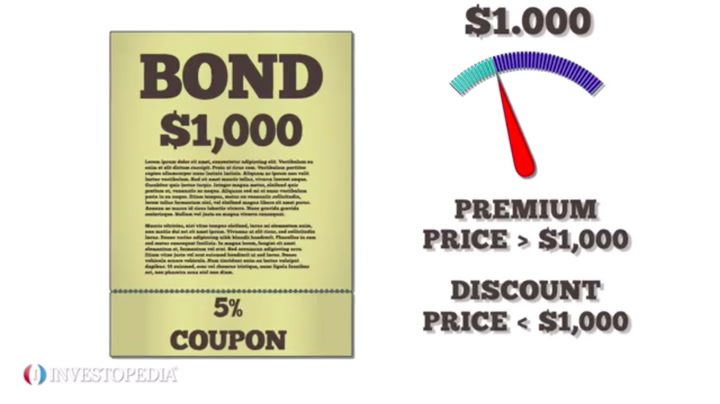

Which of the following bonds is trading at a premium. Which of the following situations increases the cost of financing through bonds. If a bond is trading at a premium this simply means it is selling for more than its face value.

A five-year bond with a 2000 face value whose yield to maturity is 72 and coupon rate is 70 APR paid semiannually. A bond with a 1000 face value trading at 1000. In other words the bond is generating a return higher than the market interest rate and therefore investors are willing to purchase the bond at a premium.

A ten-year bond with a 4000 face value whose yield to maturity is 60 and coupon rate is 59 APR paid semiannually. Which of the following bonds is trading at a premium. Which of the following bonds is trading at a premium.

The market interest rate is 5. A bond issued with a 1000 par value that trades at 1100 is trading at a premium. If a coupon bond is selling at par its current yield equals its yield to maturity.

A bond trading at its face value is trading at par Current Yield. This is because investors want a. If market interest rates imply a YTM of 8 which of the following coupon rates will cause the bond to be issued at a premium.

A a five-year bond with a 2000 face value whose yield to maturity is 70 and coupon rate is 72 APR paid semiannually. Which of the following bonds is trading at a premiumA a five-year bond with a 2000 face value whose yield to maturity is 70 and coupon rate is 72 APR paid semiannuallyB a ten-year bond with a 4000 face value whose yield to maturity is 60 and coupon rate is 59 APR paid semiannuallyC a 15-year bond with a 10000 face value whose yield to. A 15 year bond with a 10000 face value whose yield to maturity is 80 and coupon rate is 78 APR paid semiannually B.

Which of the following bonds is trading at a premium. See the answer See the answer done loading. A five-year bond with a 2000 face value whose yield to maturity is 70 and.

For example a 1000 face value. After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules. 2 a ten-year bond with a 4000 face value whose yield to maturity is 60 and coupon rate is 59 APR paid semiannually.

Which of the following bonds is trading at a premium. C a 15-year bond with a 10000 face value whose yield to. B The yield to maturity will be equal to the coupon rate which is 5 c If the yield to.

When a bond is first issued it has a stated coupon. A five-year bond with a 2000 face value whose yield to maturity is 70 and coupon rate is 72 APR paid semiannually B. James Bond the world is not enough - Premium Trading Cards - 21 Sealed Packs.

Which of the following bonds is trading at a premium. A bond trades at a premium when it offers a coupon rate higher than prevailing interest rates. There are 3000 issued shares of 50 par 6 preferred stock.

Which of the following bonds is trading at a premium. A 5 year bond with a. For the bond above the coupon rate is equal to the market interest rate.

There are 100000 outstanding shares of common stock. Assume the following scenario. Bonds trade at a premium when the current price is higher than the face value.

IF c r AND Bond price F then the bond should be selling at a premium. 1 a five-year bond with a 2000 face value whose yield to maturity is 70 and coupon rate is 72 APR paid semiannually. The total dividend available for the year is 60000.

A a ten-year bond with a 4000 face value whose yield to maturity is 60 and coupon rate is 59 APR paid semiannually b a two-year bond with a 50000 face value whose yield to maturity is 52 and coupon rate is 52 APR paid monthly. B a ten-year bond with a 4000 face value whose yield to maturity is 60 and coupon rate is 59 APR paid semiannually. A a five-year bond with a 2000 face value whose yield to maturity is 70 and coupon rate is 72 APR paid semiannually B a ten-year bond with a 4000 face value whose yield to maturity is 60 and coupon rate is.

A bond whose price falls to 900 is trading at a discount. Which of the following bonds is trading at a premium. A ten-year bond with a 4000 face value whose yield to maturity is.

Of years until maturity. Which of the following bonds is trading at a premium. Which of the following bonds is trading at a premium.

A two-year bond with a 50000 face value whose yield to maturity is 52 and coupon rate is 52 APR paid monthly C. If interest rates increase the relative price change of a 10-year coupon bond will be greater than the relative price change of a 10-year zero coupon bond. Group of answer choices a five-year bond with a 2000 face value whose yield to maturity is 70 and coupon rate is 72 APR paid semiannuallya ten-year bond with a 4000 face value whose yield to maturity is 60 and coupon rate is 59 APR paid semiannuallya 15-year bond with a 10000 face value whose yield to.

A 10 year bond with a 4000 face value whose yield to maturity is 60 and coupon rate is 59 APR paid semiannually C. IF c r then the bond should be selling at par value. A a five-year bond with a 2000 face value whose yield to maturity is 70 and coupon rate is 72 APR paid semiannually.

This is the amount of interest thats paid on its 1000 face value. Bond investments should be evaluated in the context of expected future short and long-term interest. Which of the following bonds is trading at a premium.

A The bond is default-free and so must be trading at the risk free rate. The bond trading at a premium price. A premium bond is a bond trading above its par value.

For example a 1000 face value bond selling at 1200 is trading at a premium.

Discount Bond Bonds Issued At Lower Than Their Par Value

No comments for "Which of the Following Bonds Is Trading at a Premium"

Post a Comment